Inca One’s Value Proposition and Growth Outlook

It’s rare to find a stock that boasts both a strong value proposition and a promising growth outlook. Which is why I will spotlight Inca One Gold Corp (TSXV: INCA, OTCQB: INCAF), a mining operation based in Peru.

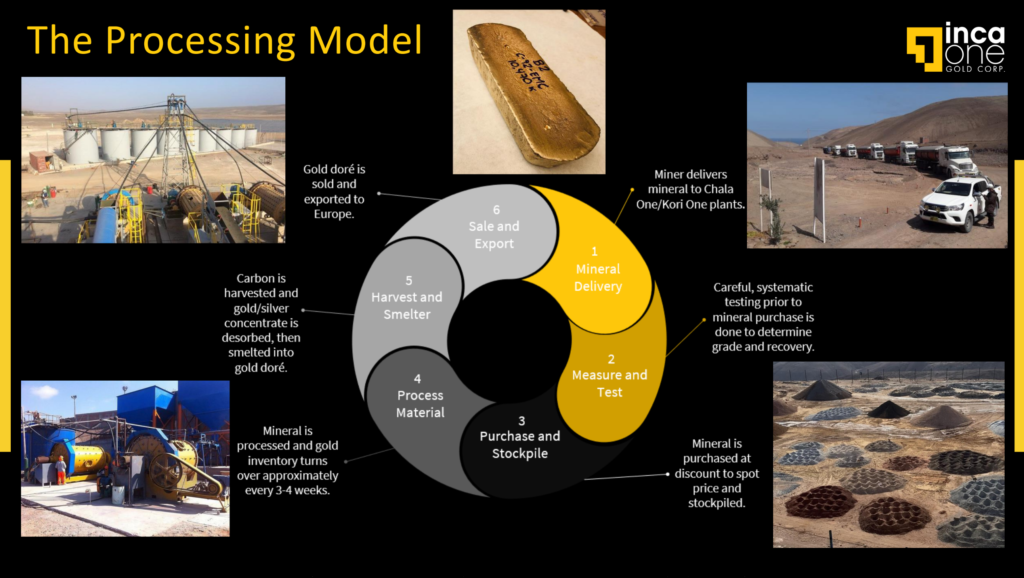

With two gold ore processing plants boasting a combined processing capacity of 450 tonnes per day, giving the Company the ability to produce 100,000 Oz per year. Inca One represents an undervalued find in the mining sector. The replacement cost for such extensive infrastructure today is estimated at $45 million USD, not to mention the added value of existing power and road infrastructure, and the significant time and effort saved in permitting processes.

Despite these assets, Inca One’s market valuation hovers just under $5M USD, presenting a striking contrast that begs for a closer examination. This valuation discrepancy becomes even more intriguing when considering that Inca One is not just an asset-heavy entity but is also generating revenue and is already in production. In 2023 the Company had sales of over $40M USD.

The only caveat? They are not yet operating at full capacity. With a vast supply of ore available for purchase and processing, Inca One’s underutilized capacity is a clear pathway to significant growth.

Mining for Growth: Inca One, Dynacor Comparison

To fully grasp the potential that Inca One presents, it is helpful to draw a comparison with a highly similar operation: Dynacor (TSX: DNG). Dynacor operates a similar business model servicing Artisanal Scale Miners in Peru and was one of the best performing stocks on the TSX in 2023.

Over the years Dynacor’s capacity expansions have resulted in present day processing capacity of 500 tpd, just a 10% edge over Inca One. The resulting revenue growth yielded tremendous share price growth. Dynacor shares rallied from under 20 cents to where they are now, hovering just over 4 dollars CAD bringing Dynacor’s market cap to $150M CAD.

At present, Inca One has access to a pool of over 20,000 permitted ASM partners, from which it bought ore from 343 in 2023. This illustrates the supply of ore available to facilitate growth.

The primary hurdle for Inca One is the capital required to purchase ore for processing into dore bars, signaling the pivotal role of financing in unlocking its full capacity.

Polishing Inca One’s Gold

For now Inca One is boot-strapping at the cusp of significant expansion. With reported revenues of $2.9M USD in December 2023 to $4.58M USD in January 2024, the trajectory is clear.

Operating at a mere fraction of its potential and growing, the company stands on the brink of a breakthrough sooner or later. The acquisition of debt financing could potentially see Inca One producing at its full capacity much sooner, which could imply monthly revenues exceeding $18M USD – at full capacity Inca One can produce annual revenues of $220M USD at current gold prices.

It certainly could be worth a closer look. Please share any questions that arise in due diligence in the comments or via email.

Bill McClain – Editor of The Momentum Letter

About the author.

The Momentum Letter operates The Free Trade Report

With the dearth of easy-to-access data on company share lock-up agreements and dates, The Momentum Letter issues “The Free Trade Report” to members highlighting key share unlock dates for companies in the microcap and small cap space. To gain access to the “The Free Trade Report” database sign-up today.

Significant Past Unlocks in the last 90 days (6 of Many…)

| Ticker | Locked Shares | Unlock Date | Share Price on Unlock Date | Current Share Price | Return % Since Unlock Date | % Float Increase |

|---|---|---|---|---|---|---|

| RNCH | 19,885,271 | 10/20/2024 | 0 | 0.05 | 0 | 43.40 |

| ALEX | 18,024,834 | 11/01/2024 | 0 | 0.84 | 0 | 44.87 |

Get access to all past stock unlock data join the Free Trade Report (it’s free! )

Upcoming Unlocks in the next 90 days (6 of Many…)

| Ticker | Locked Shares | Unlock Date | Current Share Price | % Float Increase |

|---|---|---|---|---|

| MNG | 3,289,500 | 11/22/2024 | 0.03 | 11.38 |

| KETA | 3,000,000 | 11/29/2024 | 0.04 | 10.99 |

| RAIL | 7,982,226 | 11/29/2024 | 0.20 | 11.63 |

| PRTI | 5,175,422 | 11/26/2024 | 0.10 | 85.20 |

| UDOC | 1,410,000 | 12/13/2024 | 0.63 | 14.81 |

| BVCI | 2,263,978 | 02/12/2025 | 0.70 | 10.69 |

Get access to all upcoming stock unlock data join the Free Trade Report (it’s free! )

Unlock your access to more companies and more tools by joining “The Free Trade Report”. The Momentum Letter will deliver weekly updates such as when new companies are added to the database, new unlock dates approach and recent market impacting unlocks along with other valuable information to your inbox. You can login here or visit the registration page to create your account. (it’s free!)

Disclaimer

The Momentum Letter is a marketing partner which has received

compensation to direct traffic to this coverage. Full Disclaimer