Overnight Success: Years in the Making

In the fast-paced world of technological innovation, the term “overnight success” is often misleading. These so-called overnight successes usually result from years of unnoticed hard work, persistent research, and unwavering dedication. Such is the story of Volt Lithium Corporation (TSXV: VLT, OTCQB: VLTLF), a Canadian technology company that has been quietly revolutionizing the lithium extraction industry, yet is only now beginning to capture the market’s attention with its groundbreaking advancements.

For years, Volt has been developing a technology that could redefine the economics of lithium production. In a series of milestones announced over the past year, they have introduced their innovative method of extracting lithium from the brine produced as a byproduct in oil and gas fields. Despite the significance of these announcements, the broader market and industry experts have met them with skepticism, unable to fathom the potential of what Volt claims to have achieved.

Volt’s innovation lies in its ability to (extremely!) economically extract lithium from the electrolyte-rich solution that comes to surface with oil or natural gas during the extraction process. This brine, typically considered a waste product and pumped back underground to maintain well pressure, is now being seen in a new light. Volt’s technology transforms this once valueless byproduct into a vital resource for the burgeoning electric vehicle industry, positioning the company to become one of the lowest-cost producers of lithium chemicals essential for battery manufacturing.

The skepticism surrounding Volt’s claims is reminiscent of many historical instances where disruptive innovations were initially dismissed. Only through diligent research and a willingness to look beyond conventional paradigms can one appreciate the true potential of such advancements. Volt’s journey exemplifies the notion that innovation often goes unnoticed until it reaches a tipping point, seemingly catching the world by surprise.

As Volt moves towards commercializing its technology, those who have paid close attention and done their due diligence understand that the company’s progress is real and significant. The potential re-rate of their share price upon the subsequent demonstration of success could be a wake-up call to the broader market and industry experts alike, signalling that Volt’s years of effort are culminating in what appears to be an “overnight success.”

In drawing parallels to other transformative moments in history, we can see that Volt’s story is not an anomaly but a testament to the enduring spirit of innovation. Their ability to turn a waste product into a valuable commodity exemplifies how persistent effort and ingenuity can challenge the status quo and redefine industries. As we dig into Volt’s journey, it becomes clear that their success, while to some may seem sudden, has been years in the making, and the implications of their work have the potential to drastically reshape the future of lithium extraction and the broader battery industry.

Why Skepticism Surrounds Volt’s Technological Process

To understand why industry experts and the broader market might dismiss Volt’s technological process as misleading or false, it’s essential to understand the historical skepticism surrounding direct lithium extraction (DLE) and the challenges faced by other companies in this field.

Historical Skepticism of DLE

Just a few years ago, at industry events like the PDAC conference in Toronto, the notion of direct lithium extraction was widely dismissed. Experts and laypersons alike believed that extracting lithium from a lithium-rich fluid using a short-time-frame technological and chemical process was nearly impossible.

As I curiously conversed with the small handful of DLE presenters on the conference floor, it happened on multiple occasions that a “good samaritan” passerby stopped to warn me that none of these DLE technologies would ever work.

Comparative Examples: Standard Lithium and Lake Resources

In recent years, some companies have made progress in DLE, helping to shift perceptions slightly. Standard Lithium (NYSE: SLI), in partnership with Koch Industries, has been working on extracting lithium from non-oil field brines—specifically, lithium-rich underground reservoirs in the Smackover formation in Arkansas. Despite their advancements and demonstration-level production, they have not achieved commercial-scale production, even with significant financial backing and technological support from Koch Industries.

Similarly, Lake Resources, collaborating with Lilac Solutions (a Bill Gates-backed technology company), has been working on a DLE process for its lithium brine assets. Like Standard Lithium, they have made progress but have yet to produce lithium at a commercial scale. Both companies’ inability to scale up has contributed to the ongoing skepticism within the industry.

Challenges Faced by Volt

Volt faces even greater skepticism because they are working with lower concentration brines found in oil and gas fields across North America. These brines, which come up via existing infrastructure, are not only less lithium-rich but also contain petrochemicals, adding to the perceived technological challenge.

Industry experts find it hard to believe Volt can succeed where others with higher concentration brines and fewer contaminants have not yet scaled. The notion that Volt can achieve commercial success with more challenging inputs understandably seems implausible to many.

Overcoming Skepticism: Audited Progress

Despite these challenges, Volt has made significant strides, validated by third-party engineering and auditing firms. These firms have audited Volt’s processes, additives, reagents, and energy usage, confirming its reported progress is accurate and credible. This third-party validation is crucial in countering the skepticism and proving that Volt’s technological process is indeed working.

The market’s disbelief is understandable given the historical context and the challenges faced by other industry players. However, Volt’s continuous progress, validated by reputable third parties, indicates that they are on the path to achieving commercial success, potentially by the end of this calendar year.

Disruptive Yet Under-the-Radar Announcements

Over the past 12 months, Volt Lithium Corporation has made a series of disruptive yet under-the-radar announcements and press releases. Despite these significant milestones being audited by the reputable third-party engineering firm Sproule and Associates, the broader market remains incredulous of Volt’s results. Following are three key announcements that highlight Volt’s progress and potential.

Successful Pilot Program

The first notable achievement was Volt’s successful pilot program. Initially, Volt processed lithium extraction at lab and bench scale, dealing with small containers of brine, around five liters each. However, in the pilot phase, Volt scaled its process 400 times, processing 2,000 liters of brine per run. This meticulous process involved checkpoints at every step to measure reagent usage, energy consumption, and lithium concentration in the solution.

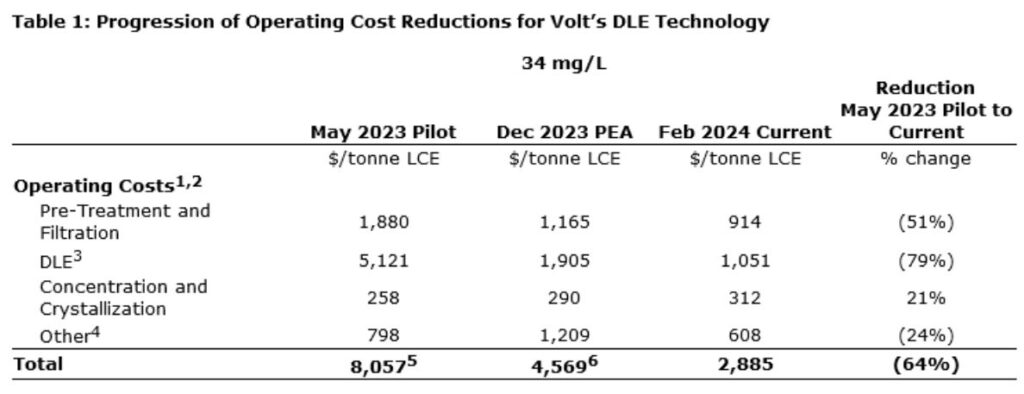

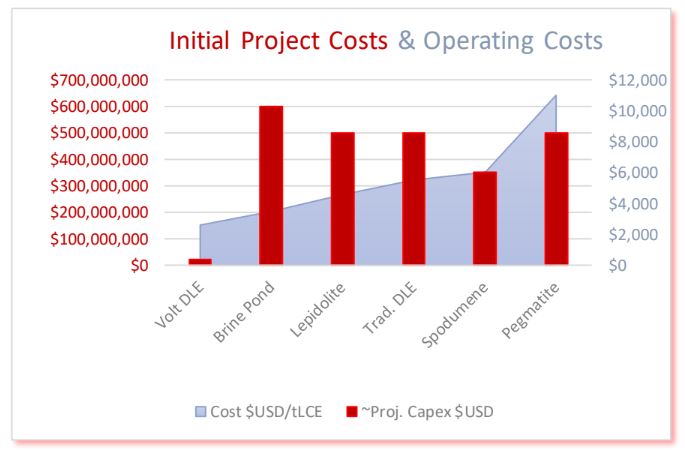

The results were impressive: Volt achieved over 90% lithium extraction on every run from brine sourced from an oil field in Rainbow Lake, Alberta. The economics of this process were also promising, having the lowest cost for lithium carbonate equivalent production of approximately $3,000 per tonne from the highest concentration brines (121 mg/L) and higher costs for lower concentration brines (34 mg/L). Given that lithium carbonate and lithium hydroxide market prices, even in a depressed state, are around $14,000 per ton at the time of this writing, these figures are compelling.

Permanent Demonstration Plant

Building on the pilot’s success, Volt established a permanent demonstration plant in Calgary, Alberta. Progress at this plant further reduced operating costs to $2,900 USD per tonne for brine with 34 mg/L lithium concentration – a 64% cost reduction over the initial successes in the pilot. This significant cost reduction was achieved while simulating commercial operations, making Volt’s process extremely economically viable, even for low concentration brines.

Interest from oil and gas producers across North America surged following the pilot’s success. Despite the market’s lack of enthusiasm reflected in Volt’s share price, these producers sent brine samples to Volt for testing. Volt’s technology proved effective on all samples, regardless of contaminants or total dissolved solids, demonstrating the robustness of their process.

While it would be nice to know exactly which oil and gas producers have been sending in brine, all agreements are currently under NDA.

Strategic Investment

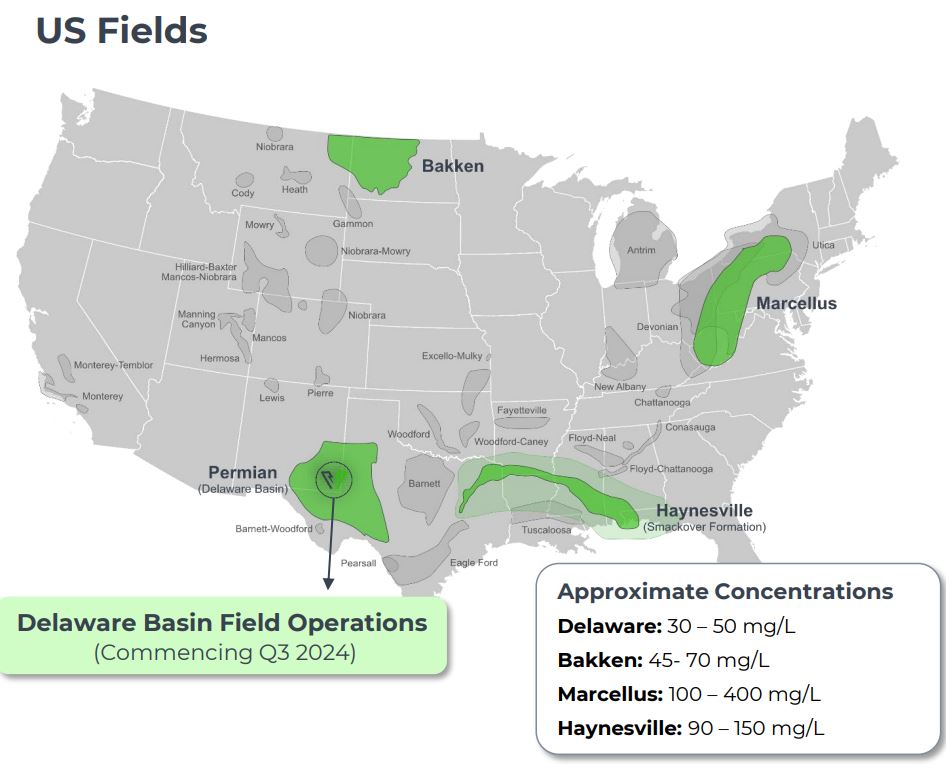

Perhaps the most validating announcement came with a $1.5 million U.S. strategic investment from an undisclosed oil and gas field operator in the Permian Basin. The Permian Basin is the most productive in North America, with a high ratio of brine to oil, making it an ideal location for Volt’s technology. This investment followed the operator’s thorough technical due diligence, who wanted Volt to deploy a field unit to demonstrate their technology on-site in the Permian Basin.

Volt’s CEO, Alex Wiley, confirmed that this operator’s executive team visited the demonstration plant and witnessed Volt’s process in action. The successful demonstration led to the strategic investment, with plans for follow-on capital upon the field unit’s success.

These announcements demonstrate Volt’s successful progress in developing and validating their lithium extraction technology. Despite market skepticism, the audited results and strategic investment from a major oil and gas operator validate Volt’s potential to revolutionize the lithium extraction industry. As Volt moves closer to commercial success, these milestones highlight the years of hard work and innovation behind what may soon be recognized as an “overnight success.”

Why Volt’s Technology is So Disruptive Yet Unrealized

Despite skepticism from industry experts and the broader market, Volt’s technology represents a groundbreaking shift in lithium extraction, with the potential to disrupt the industry in ways that have largely gone unnoticed. This disruption stems from several key factors:

Current Lithium Supply Chain

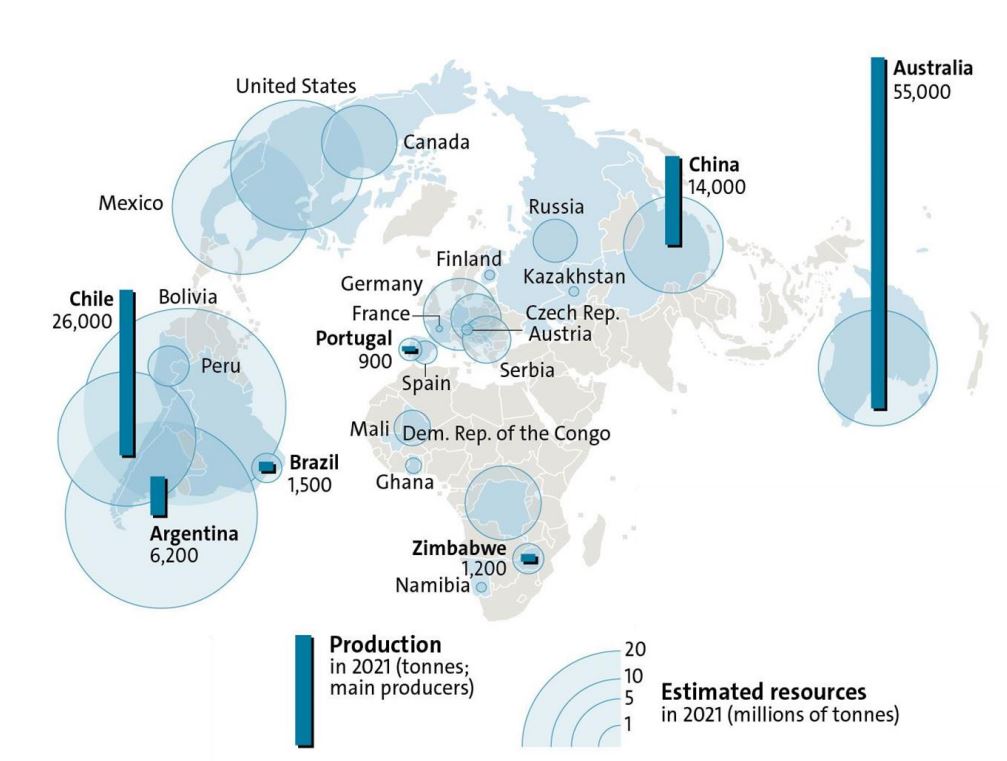

North America’s current lithium supply is almost non-existent. Most lithium mining occurs in Australia and South America, with the raw material then being refined in China. This global supply chain is not only inefficient but also politically and economically vulnerable. Volt’s technology offers a solution by enabling North America to produce battery-grade lithium chemicals domestically from start to finish.

Strategic Importance of Domestic Production

The U.S. and Canada have recognized the critical need to onshore and “friend shore” their lithium chemicals production. This realization is reflected in various government incentives, such as rebates for electric vehicles (EVs) that use North American-produced lithium and other strategic critical minerals programs to fund new mines for the green energy revolution. These initiatives are designed to reduce dependence on foreign supply chains, particularly those involving China.

Speed and Cost of Deployment

Traditional lithium mining projects can take five to ten years and cost billions of dollars to bring into production. In contrast, Volt’s technology leverages existing oil and gas infrastructure to produce lithium from a waste product already being generated. This means Volt can commence and scale production much more rapidly and at a fraction of the cost (CAPEX.)

Proven Efficiency and Scalability

Volt’s technology has demonstrated significant efficiency and scalability. In their pilot program, Volt processed 2,000 liters of brine per run with over 90% lithium extraction. This process, audited and validated by Sproule and Associates, showed production costs below $3,000 per ton of lithium carbonate equivalent, making it economically viable even with lower concentration brines.

Building on this success, Volt established a permanent field simulation center (the demonstration plant) in Calgary, Alberta. Initially, this center had the capacity to process roughly 500 barrels of brine per day. However, it has since been upsized to match the capacity of the field unit, now with processing capacity of 1,200 barrels per day.

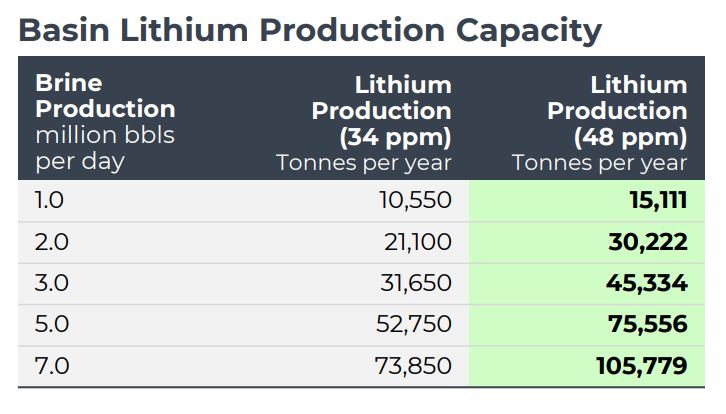

The construction of a permanent demonstration plant in Calgary further reduced operating costs to approximately $2,900 per ton for brines with 34 mg/L lithium concentration. Moreover, Volt’s field unit to be deployed in the Permian Basin will initially process 1,200 barrels of brine per day and can scale up to 6,000 barrels per day by reducing contact time from two and a half hours to as low as 20 minutes.

Strategic Investment and Market Potential

A $1.5 million strategic investment from an undisclosed oil and gas operator in the Permian Basin underscores Volt’s disruptive potential. This investment followed extensive due diligence and reflects confidence in Volt’s ability to deliver commercial-scale production. The Permian Basin alone produces over 18 million barrels of water per day, presenting a massive opportunity for Volt to scale rapidly.

Economic and Environmental Benefits

Volt’s technology not only provides a rapid, cost-effective solution for lithium production but also offers environmental and economic benefits for oil and gas companies. By extracting lithium from produced water, these companies can generate additional revenue, extend the life of their infrastructure, and reduce costs through shared expenses. Additionally, this process contributes to ESG (environmental, social, and governance) goals by supporting both fossil fuel and renewable energy sectors.

The Road Ahead for Volt Lithium

Volt’s innovative approach to lithium extraction is a testament to the potential for disruptive technology to transform industries. By leveraging existing infrastructure and producing lithium domestically, Volt addresses critical supply chain vulnerabilities and aligns with strategic initiatives for North American production. As the validation of their technology continues, Volt is on the brink of proving the naysayers wrong and realizing its potential as one of the most significant disruptors in the lithium market. The final hurdle of scaling to commercial production is in sight, making Volt an opportunity that the market may be unable to ignore much longer.

Bill McClain – Editor of The Momentum Letter

About the author.

Disclosure: I own shares purchased through private placements and in the open market and am therefore favorably biased towards Volt Lithium. I intend to sell shares at some point in the future for a profit. I implore any intrigued parties to conduct their own due diligence. The investor presentation and research report below are a good place to start. Click the images to download or open the pdf files.

Volt Investor Presentation

Volt Research Report

The Momentum Letter operates The Free Trade Report

With the dearth of easy-to-access data on company share lock-up agreements and dates, The Momentum Letter issues “The Free Trade Report” to members highlighting key share unlock dates for companies in the microcap and small cap space. To gain access to the “The Free Trade Report” database sign-up today.

Significant Past Unlocks in the last 90 days (6 of Many…)

You are trying to load a table of an unknown type. Probably you did not activate the addon which is required to use this table type.

Get access to all past stock unlock data join the Free Trade Report (it’s free! )

Upcoming Unlocks in the next 90 days (6 of Many…)

You are trying to load a table of an unknown type. Probably you did not activate the addon which is required to use this table type.

Get access to all upcoming stock unlock data join the Free Trade Report (it’s free! )

Unlock your access to more companies and more tools by joining “The Free Trade Report”. The Momentum Letter will deliver weekly updates such as when new companies are added to the database, new unlock dates approach and recent market impacting unlocks along with other valuable information to your inbox. You can login here or visit the registration page to create your account. (it’s free!)