Borealis Mining Company presents a rare opportunity in the micro-cap mining and exploration sector. Led by a seasoned leadership team and supported by strong investor backing, Borealis has strategically acquired a fully permitted gold mine, complete with USD $50-$70 million in high-quality infrastructure, at a significantly discounted price. This acquisition positions the company for growth, offering a compelling opportunity in a market that often overlooks the potential of such assets.

Borealis’ Board and Backers: A Powerhouse Team in a Small Package

Despite a market cap of approximately CAD $70 million, Borealis Mining (TSXV: BOGO; FSE: L4B0) boasts a board of directors and investor roster that would be impressive even for companies ten times its size. It’s rare to find a sub-$500 million mining company with such an experienced and successful team at the helm.

Industry Titans Leading the Way

- Tony Makuch, Chairman: Former CEO of Kirkland Lake Gold, he transformed it from a small producer into a multi-billion-dollar industry leader.

- Bob Buchan, Director: Founder of Kinross Gold, he built it into one of the world’s largest gold mining companies.

I encourage you to look up each member of Borealis’ board—you’ll be intrigued by their accomplishments.

Prominent Investors Backing Borealis’ Plan and Vision

- Rob McEwen: A billionaire mining magnate and owner of McEwen Mining, holds nearly 16% of Borealis.

- Eric Sprott: Renowned resource investor, owns just under 7%.

Their substantial investments signal strong confidence in Borealis’ strategy and potential. These are just a couple of the prominent and successful resource investors and resource funds backing the company and its vision. In fact, institutions already own over 31%.

The Forgotten Gem: Borealis Gold Project

A Mine and Highly Prospective Exploration Asset Frozen in Time

Borealis Mining acquired the Borealis gold project, a Nevada mine with a storied past. Work on the asset abruptly stopped over a decade ago due to legal disputes, leaving:

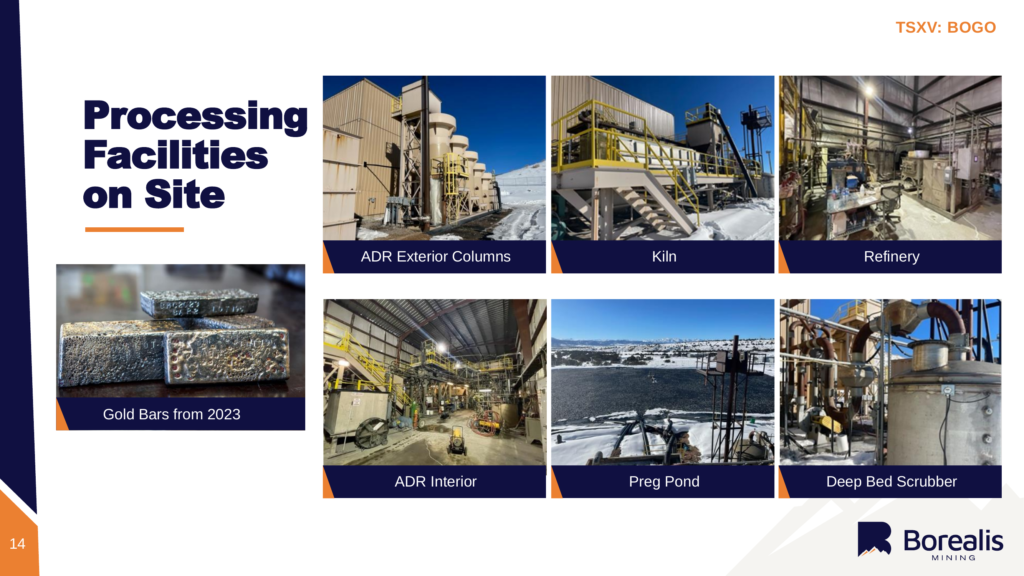

- Pristine Infrastructure: Fully permitted ADR plant, heap leach pad, power substation, wells—all in excellent condition.

- Untapped Resources: Exploration ceased suddenly, preserving immense potential in both oxide and sulfide deposits.

Borealis’ Deep Value Purchase: Acquired at a Fraction of Its Value

The company secured the project for USD $100,000 in cash and approximately $5 million in equity, a remarkable deal considering the infrastructure’s replacement cost is estimated between USD $50 million and $70 million.

Immediate Revenue and Exploration Upside

Borealis is Generating Cash Flow Now

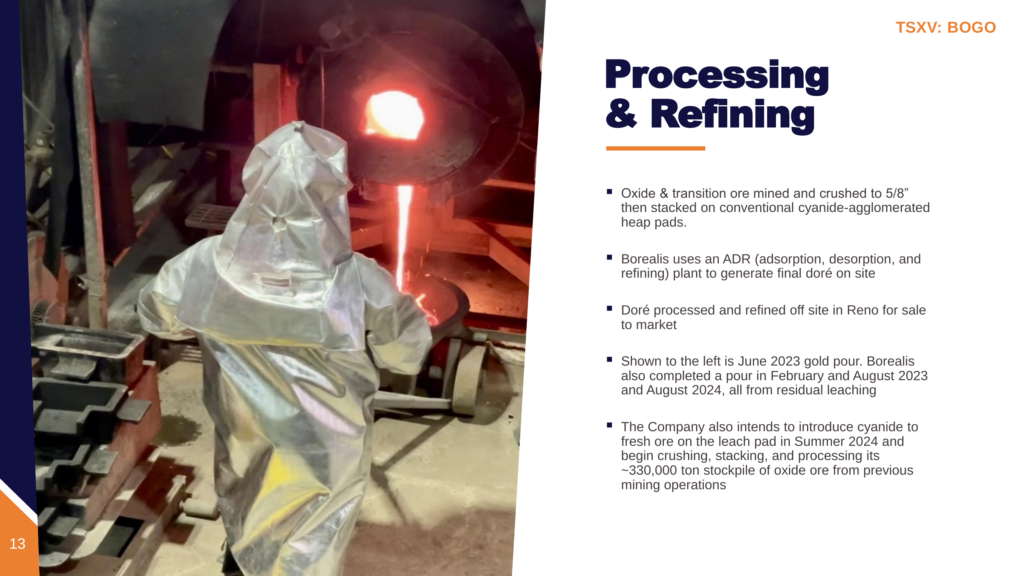

- Residual Leaching: Ongoing gold pouring from existing leach pads. (see recent news releases for more information on gold pours.)

- Untreated Leach Pad Sections: Areas yet to undergo cyanide treatment, promising near-term gold production.

- Stockpiled Ore: 330,000 tons of oxide ore ready for processing, leading to increased gold pours in the coming months.

The Borealis Project: Vast Exploration Potential

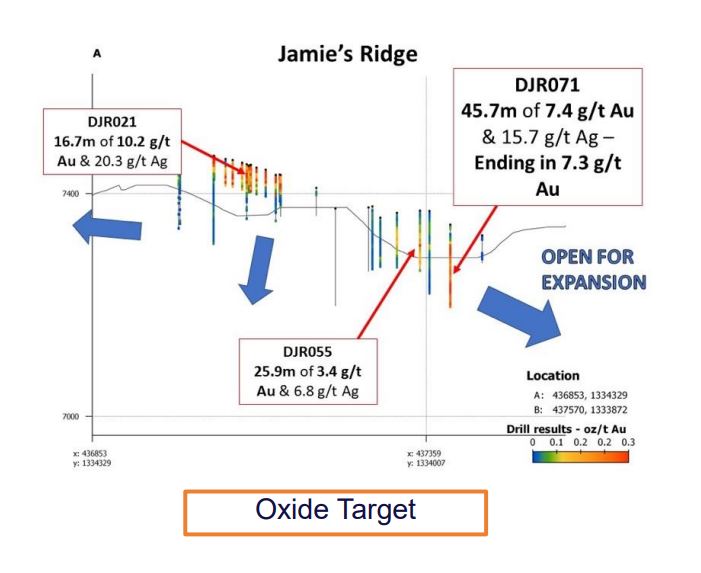

High-Grade Oxide Deposits

- Freedom Flats Pit: Discovered under alluvial cover, produced 200,000 ounces at 5 grams per ton.

- Jamie’s Ridge Pit: Last drill hole intercepted 45+ meters at 7.4 grams per ton, ending in mineralization of 7.3 grams per ton—indicating more gold at depth and on trend.

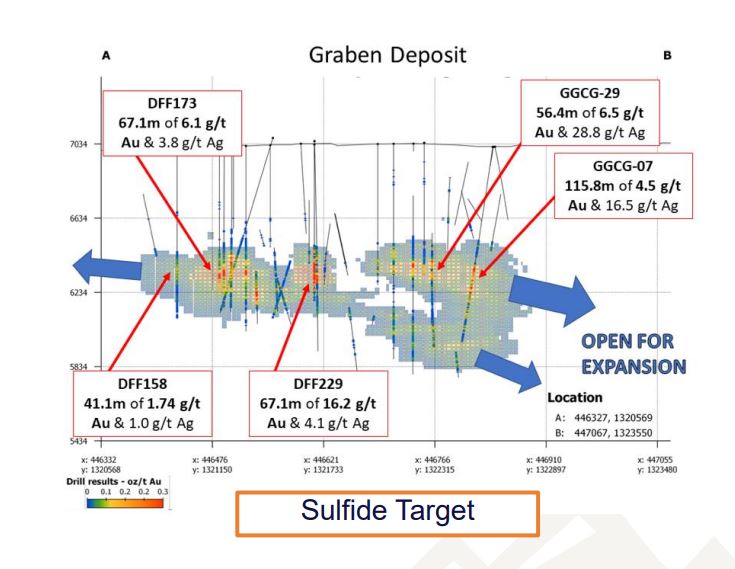

Significant Sulfide Deposits at Depth

- Historical Resource: Approximately 1 million ounces (non-current, historical) of sulfide gold awaiting further exploration and expansion.

- Spectacular Drill Results: Intercepts like 67+ meters at 16 grams per ton and 115 meters at 4.5 grams per ton remain unexploited or followed up on with more exploration.

Leveraging Underutilized Infrastructure for Greater Value

While the exploration upside is compelling on its own, Borealis Mining has an additional advantage: underutilized infrastructure that can be leveraged to unlock significant shareholder value.

Maximizing Existing Facilities

- Operational Efficiency: The fully permitted processing facilities are currently operating below capacity.

- Cost Savings: Utilizing existing infrastructure minimizes capital expenditure and accelerates time to production.

- Scalability: Ready-to-use facilities allow for the quick ramp-up of operations as new resources are brought online.

Unlocking Regional Opportunities

- Strategic Location: Situated in a prolific mining region, there are numerous undervalued, medium-sized gold deposits nearby.

- Competitive Edge: Borealis can produce gold from surrounding deposits more efficiently than competitors lacking similar infrastructure.

- Economies of Scale: Shared management and operational teams reduce overhead costs, enhancing profitability.

By capitalizing on its underutilized capacity, Borealis can unlock value from surrounding assets, transforming underappreciated deposits into profitable ventures and delivering greater returns to shareholders.

Strategic Growth Through Acquisitions

Building on this strategic advantage, Borealis plans to expand through targeted acquisitions.

Leveraging Infrastructure for Expansion

With the ability to produce more gold, Borealis aims to:

- Acquire Nearby Assets: Targeting undervalued deposits too small for majors but profitable for Borealis.

- Optimize Operations: Use existing permits and infrastructure to reduce costs and expedite production.

- Deploy Expertise: Leverage the team’s proven operational and managerial capabilities to enhance new projects.

Proven M&A Expertise

Board members like Tony Makuch and Bob Buchan have a history of growing companies through strategic acquisitions—a strategy Borealis intends to replicate. Their experience in identifying valuable assets and integrating them efficiently positions the company for accelerated growth.

Why Borealis is Worth a Closer Look

- Unparalleled Leadership: A team with a track record of building billion-dollar companies.

- Strong Investor Confidence: Significant ownership by industry heavyweights.

- Immediate and Long-Term Upside: Cash flow from current operations, vast exploration potential, and the ability to leverage underutilized infrastructure.

- Strategic Growth Plan: Clear path to becoming a mid-tier producer through smart acquisitions and efficient operations.

With a valuable asset in hand and a strategic plan for growth, Borealis Mining Company (TSXV: BOGO; FSE: L4B0) is well-positioned for potential success. By focusing on production-backed exploration—using mining operations to fund and drive the company’s growth—they aim to build a sustainable and profitable business.

Bill McClain – Editor of The Momentum Letter

About the author.

The Momentum Letter operates The Free Trade Report

With the dearth of easy-to-access data on company share lock-up agreements and dates, The Momentum Letter issues “The Free Trade Report” to members highlighting key share unlock dates for companies in the microcap and small cap space. To gain access to the “The Free Trade Report” database sign-up today.

Significant Past Unlocks in the last 90 days (6 of Many…)

You are trying to load a table of an unknown type. Probably you did not activate the addon which is required to use this table type.

Get access to all past stock unlock data join the Free Trade Report (it’s free! )

Upcoming Unlocks in the next 90 days (6 of Many…)

You are trying to load a table of an unknown type. Probably you did not activate the addon which is required to use this table type.

Get access to all upcoming stock unlock data join the Free Trade Report (it’s free! )

Unlock your access to more companies and more tools by joining “The Free Trade Report”. The Momentum Letter will deliver weekly updates such as when new companies are added to the database, new unlock dates approach and recent market impacting unlocks along with other valuable information to your inbox. You can login here or visit the registration page to create your account. (it’s free!)

Disclaimer

The Momentum Letter is a marketing partner which has received

compensation to direct traffic to this coverage. Full Disclaimer