Reklaim: Leading the Data Privacy Revolution

By now we all know that online companies like Facebook, Google and Amazon are collecting troves of information about us and selling it to the highest bidder.

People are tired of being spied on and having their personal data bought and sold without their knowledge or consent.

This $400 billion data market is ripe for a revolution. Both consumer sentiment and legislation are signaling that changes to the current status quo will accelerate in the very near term.

Reklaim (TSXV: MYID, OTCQB: MYIDF) is the North American company at the center of the inevitable data privacy revolution.

Reklaim puts consumers back in control of their data by providing them with a platform where they can view, edit, opt-out, or be compensated for the use of their data.

On the flip side of the transaction, Reklaim provides a platform for brands and others in the data market to buy and sell consumer-consented privacy-compliant data.

Given the current legislative landscape this new paradigm of data markets is poised to be massive much sooner than many would expect. Despite this growth potential Reklaim somehow remains undervalued based on present revenues and trajectory.

Reklaim’s Present Valuation A Compelling Opportunity

Microcaps, particularly those in the tech sector, have all had major valuation drawdowns over the last 10 months.

When rising interest rates started causing the cost of capital to increase most companies didn’t change their burn rate or extend their runway. They didn’t give themselves a chance to get to profitability before running out of cash – a large part of the reason this segment has so seriously suffered.

But among those companies that have had 80% drawdowns, there are a handful of stellar opportunities. Companies that have been extending their runway and rounding the corner of being cash-flow positive. Reklaim is one of those companies.

Reklaim has been driving revenues, stripping out costs and starting to scale.

Considering the following facts from recent months’ company news:

- Operations streamlined to cash-neutral position after two years of building its infrastructure, distribution, and scale

- Revenues up 277% to $645,008 from $171,070, Q1-2022 versus Q1-2021

- Recurring revenue comprises 87% of revenue total YTD at end of Q2-2022

- Platforms’ revenue up 66% quarter over quarter and 234% year over year

- Added 33 new B2B clients during Q2-2022, up 51% from Q1-2022

- Margins up 99% Q2-2022 versus Q1-2022, from -106% to -1%

On June 30, Reklaim had over $1 million in cash equivalents. They are both well financed and now operating at cash flow neutral.

As of this writing, Reklaim (TSXV: MYID) is trading at $0.08 CAD putting its market cap just over $7 million CAD. That’s an astonishingly low multiple on revenues for a tech company with such high revenue growth and a growing list of Fortune 500 clients such as Microsoft, Bayer, Amgen and HP.

Reklaim: Industry Leader Amid Growing Macro Trend

Data privacy is the biggest macro trend that no one is paying attention to right now.

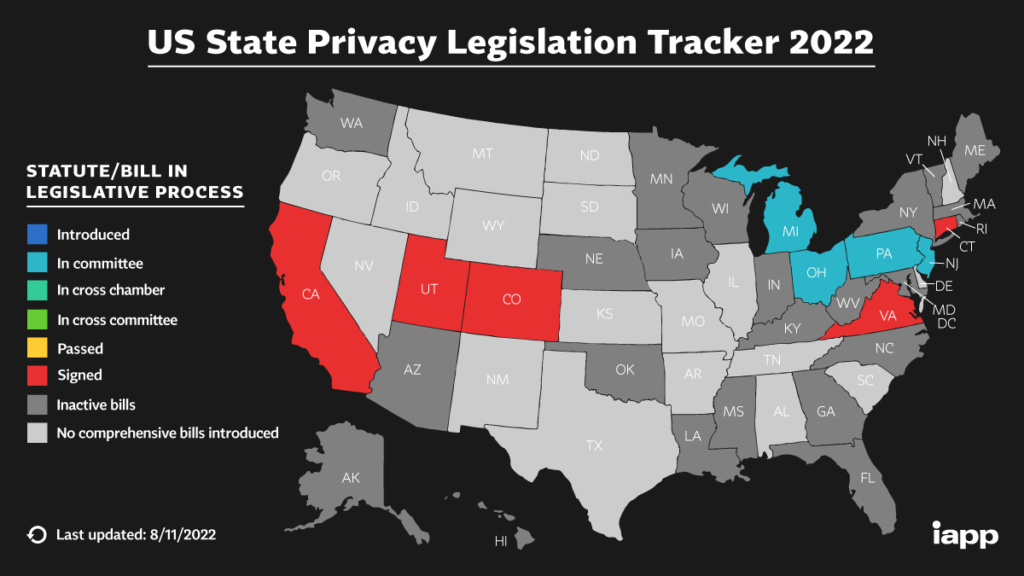

In the U.S. there are only 18 states that have yet to introduce a comprehensive privacy bill. Only 5 states have bills signed. That’s 27 bills amid legislation at the moment with another 18 bills likely to soon follow.

There is no question, the U.S. is moving towards a Federally driven privacy policy.

Reklaim has spent the last 4 years building out its infrastructure precisely to meet the incoming demand as privacy regulations sweep the globe.

Their systems are ready to scale as demand comes online. Early signs of that demand growth are clearly visible in the quarter-over-quarter growth of recurring revenue.

It’s estimated that privacy regulations will cover 75% of the world’s population by 2024. Yet this macro trend being accelerated by regulations has been largely ignored by the broader community of investors.

Reklaim’s Vision Coming to Fruition

Reklaim’s CEO, Neil Sweeney, is a 20 year veteran of the digital technology industry with multiple past 8-figure exits.

Over the last 5 years Neil has invested millions of dollars of his own money and countless hours making his vision for the digital data market become a reality.

That vision has now yielded a consumer facing service that nearly every consumer on the planet should want and every player in the data markets will soon need:

- A consumer platform to monitor data breaches, view data being collected, opt-out or choose to be compensated for the use of personal data. Consumer data is scanned weekly across 30,000 different sources to update data leaks on any external platform.

- A platform providing consumer-consented, privacy-compliant data for brands and other data buyers and sellers.

This is a vision I can support and a movement I see as inevitable.

Reklaim is uniquely positioned to both provide and capture a massive amount of value as the digital data privacy movement advances.

I encourage any prospective investors to explore their own data profile at www.reklaimyours.com. With over 320 million profiles in their database, chances are you’ll find your own profile there.

Bill McClain – Editor of The Momentum Letter

About the author.

The Momentum Letter operates The Free Trade Report

With the dearth of easy-to-access data on company share lock-up agreements and dates, The Momentum Letter issues “The Free Trade Report” to members highlighting key share unlock dates for companies in the microcap and small cap space. To gain access to the “The Free Trade Report” database sign-up today.

Significant Past Unlocks in the last 90 days (6 of Many…)

You are trying to load a table of an unknown type. Probably you did not activate the addon which is required to use this table type.

Get access to all past stock unlock data join the Free Trade Report (it’s free! )

Upcoming Unlocks in the next 90 days (6 of Many…)

You are trying to load a table of an unknown type. Probably you did not activate the addon which is required to use this table type.

Get access to all upcoming stock unlock data join the Free Trade Report (it’s free! )

Unlock your access to more companies and more tools by joining “The Free Trade Report”. The Momentum Letter will deliver weekly updates such as when new companies are added to the database, new unlock dates approach and recent market impacting unlocks along with other valuable information to your inbox. You can login here or visit the registration page to create your account. (it’s free!)

Disclaimer

The Momentum Letter is a marketing partner which has received

compensation to direct traffic to this coverage. Full Disclaimer