Signs of a Microcap Multi-Bagger (or How to Pick a Winner)

Today I’m going to dig into the promising news from Delic Corp. (CSE: DELC, OTCQB: DELCF) – the world’s first psychedelic corporation. The news signals the start of Delic’s move toward generating significant revenues in the nascent psychedelics space. But first I want to take a step back and briefly revisit a few very important factors when evaluating an investment thesis.

- Know what you own and know why you own it. Yes, this is very straightforward but it can sometimes be too easy to get caught up in the hype – especially in a “hot new sector.”

- It is far better to own a business growing its position in an expanding market than to own one fighting for the scraps of a stagnant or shrinking sector. Speaking of “hot new sectors,” that is generally a good place to look for best-of-breed investment picks in an expanding market.

- Leadership is of the utmost importance. I want the leadership of companies I own to be flush with vision, focus and commitment. In the microcap space in particular, an investment is a bet on company leaders and their ability to successfully execute a well planned vision of the future.

Why Bet on Delic Corp. Leadership?

Why am I willing to make a bet on Delic CEO Matt Stang and the rest of the leadership on board?

Here are three quick reasons.

- Because Matt spent 21 years as an executive and owner of High Times magazine – his last title was Chief Revenue Officer.

His time there helped him establish one of the biggest business networks in the alternative drug space. These relationships will prove instrumental to Delic initiatives along the lines of acquisitions and brand building. - Because Matt and the Delic team understand how to build a brand that appeals to the very demographic that is – or will become – interested in participating in the psychedelics space.

- Because Matt and his vision for Delic are believed in, backed and guided by Directors that have had enormous success in what I would call “sibling industries.”

Director Paul Rosen was the President and CEO of Pharmacan Capital Corp. – the company that went on to do business as Cronos Group (NASDAQ: CRON, TSX: CRON), a $5.6 billion cannabis behemoth.

Director Kraig Fox was the CEO and President of High Times magazine. It marks an additional vote of confidence seeing Matt’s highly successful former boss back his next business venture by the way.

I don’t always put a lot of weight on endorsements but they are hard to ignore when coming from successful executives in similar lines of business.

Delic Corp. Preparing for Lift-Off

Today Delic announced their intention begin acquiring legally operating psychedelic wellness clinics. These acquisitions would distinguish Delic from many other psychedelics-focused, publicly traded companies.

In particular, many companies focusing on drug development could be several years out from revenue generation. Delic’s plan all along has been to get lift-off on revenues as soon as possible and thus be positioned to benefit from the tail winds that will come with drug breakthroughs and regional regulatory shifts.

The gist of their revenue lift-off strategy is relatively straightforward and can be summarized as follows.

- Step 1: Acquire legally operating, positive cash-flow psychedelic wellness clinics.

- Step 2: Amplify revenues to those (already positive cash-flowing) clinics with their massive and far-reaching marketing arm.

- Step 3: Use those clinics as an entry-point to offer other novel treatments as regulations change to allow it.

While the gist of Delic’s near term revenue generation strategy is fairly simple, how the team got to be in the position to execute it is not. It took vision, foresight and years of building out the framework to be ready for these opportunities. Again, such vision and foresight are defining attributes of the leadership of young microcap companies that go on to find huge success.

I Love It When a Plan Comes Together

Is anybody reading this old enough to have grown up watching The A-Team?

Delic founders Matt and Jackee Stang have been intricately coordinating the cogs that make up the Delic Corp. machine for years; long before anyone else was even paying attention to the psychedelics space.

“When we started the company two years ago we were the first psychedelic corporation. It seemed a little crazy then, but now I think the world has caught up with where we started out.”

Matt Stang – CEO of Delic Corp.

One essential component of Delic’s vision that has been years in the making is their marketing arm. Delic owns Reality Sandwich, TheDelic, Delic Radio and the Meet Delic platforms.

Monthly traffic to Reality Sandwich – a psychedelic culture and information resource – grew from 25,000 visitors per month to over 220,000 between November 2019 and November 2020. If you check it out you will see why it’s the go-to resource for all things psychedelic. Chock full of beautiful art and imagery alongside informational articles, it’s no surprise that this educational resource engages anyone even mildly interested in ANYTHING psychedelic.

Let’s just pause for a moment and contemplate the long term value that each of Delic’s engaged audience members is worth to a psychedelic wellness clinic. Now consider how quickly that audience is growing and do some forward-looking arithmetic.

“We [already] have this funnel with a bunch of folks who are interested in psychedelic wellness.”

Matt Stang – CEO of Delic Corp.

Pro Tip: If you want to be a key player in any industry, go out and build THE Inbound Marketing Platform for that sector. When you bring value to people by way of honest education it is both virtuous and profitable.

That’s easier said than done. But that’s exactly what Delic has already done and now they’re set to (virtuously) capitalize on the framework they’ve spent years building.

Vision and commitment are starting to pay off.

Like a Snowball Starting to Roll Down a Mountain

Typically Delic’s business strategy would be called a “Roll-Up.” I like to think of it as a snowball. As we go through some snippets of today’s news release I think that interpretation will become more clear.

Summary: Delic is acquiring KIC inclusive of their two clinics and their 6 person team. KIC has clinics in Arizona and California and has done $1.5 million in revenue since 2019. Delic will use their media platforms to drive revenues to KIC clinics. Pretty straightforward.

Key Point: KIC management has decades of experience and has successfully scaled and exited over two dozen clinics and hospitals.

So Delic is executing their plan of acquiring cash flowing businesses but they have also acquired an experienced team with a history of opening and scaling clinics. And they plan to scale their clinic footprint throughout the country.

This is how the snowball starts to roll, accumulating clinics, teams to scale and build more clinics and aggregating best practices amongst everything under the Delic umbrella.

Key Point: Co-founder of KIC, Sonny Diaz sees the immense value of Delic’s media arm in patient acquisition and jumped at the opportunity to join forces and bring all aspects of the business under the same umbrella. He sees the opportunity to scale, and soon, as he notes with his 18 month timeline.

Other clinics could see this value too. It’s important to note that value and synergies grow along with each of Delic’s acquisitions, making them an ever increasingly attractive partner to join forces with. This is how the snowball starts to grow.

Key Point: This is a good deal structure. Delic is paying $2.25 million in shares along with an incentive bonus for KIC to hit revenue and profitability targets. It is also in alignment with common share holders as the deal stipulates an appropriate vesting structure that incentivizes the KIC team to add value to shareholders before they can extract any value in return (should they choose to exercise their right do so.)

I will also point out that with each acquisition like this one, Delic acquires IP, best business practices, physical assets and brand power. All of these things add to their leverage in negotiating future deals to acquire even more assets.

Snowball effect.

The PsycheDELIC Revolution Is Here. Are You Ready?

Mental health is a growing problem in the world. Present global conditions are certainly not providing any reprieve. The promise that psychedelics show in treating various mental issues, along with other applications strongly indicate that this “genie” is not going back into the lamp.

If I’m going to place a bet on a business in this space it’s going to be on the company that has help set the stage for the revolution and has informed the public on how to prepare for it.

Delic has been in the psychedelics streets for years informing the public with compassion, empathy and authentic education. With their first mover advantage and authentic communication they will be a hard rock to displace in this space.

The Snowball Is Still Small

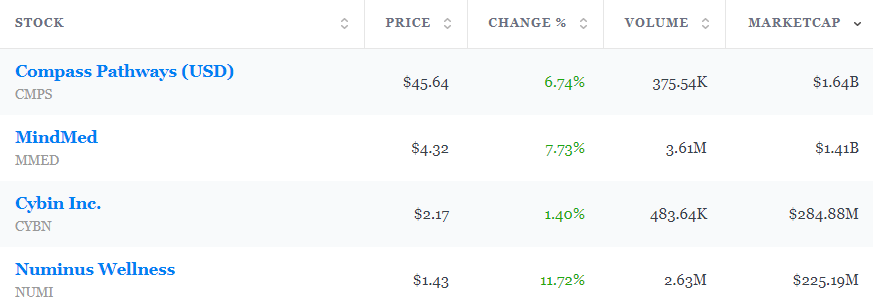

At the time of this writing Delic is trading at $0.47 USD and has market cap under $20 million USD. That’s less than 10% of the value of each of the companies below.

It is my intention to use this platform to draw attention to small companies before they become big. Those with multi-bagger potential. I look forward to seeing Delic continue to execute their business plan in the psychedelics space.

There is plenty of open space below for the snowball to roll.

Bill McClain – Editor of The Momentum Letter

About the author.

For more in depth coverage of Delic and their all-star team be sure to check out our initial coverage here: Delic Corp.: Ushering Psychedelics Into the Mainstream.

For press releases and other news/media covering Delic check out our resource and information page here.

As always, if you have questions please don’t hesitate to reach out. You can comment below, tweet at us, message us on Facebook or send us an email.

Disclaimer/Disclosure: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. All statements in articles on this website are to be checked and verified by the reader. Read our full disclaimer/disclosure here.

If this is your first time at our site please consider joining our newsletter.

Disclaimer

The Momentum Letter is a marketing partner which has received

compensation to direct traffic to this coverage. Full Disclaimer

How can I get more news

omg!! i am excited! i would love some free samples please! i can be a quality control person, i am experienced!

*inconspicuously looking around for the free-samples line up* 😀

Hello

Hi I’m just trying to get more informed about this project..

Hi! If you have any questions please ask here in the comments or send me a message. Cheers!

Hello Everyone, I’m just looking around for a solid company that delivers what they promise. I’m new at this. I’ve been mislead and lost a lot. But, I’m willing to learn and work hard. So, yes free samples sound good, more info about the project would also be great. I

Hi Marva, we’ll follow up with more news soon. In the meantime, if you have any questions please ask here in the comments or in a message directly to me.

You can also see all the news releases on our Delic Information and Resources page here: https://themomentumletter.com/our-picks/delc/

Interested

Free Samples

I am seriously considering investing in your company as the market is showing great progress. Since your company was first to introduce this product, I would love to sample the product.

Thank you

Send the sample

Your enthusiasm/curiosity is bullish for the revenues at the treatment centers!

Once people start hearing about the efficacy and life changing experiences – what happens to revenues and demand for more clinics then?

I’m interested to hear from you about this proyect

How do I start investing

I am interested in investing.

Samples and numbers and profit sheet

how do we invest?

Call your broker or login to your online brokerage and look up the ticker. Always do your own due diligence.

If you need further assistance you can email me directly.

Thanks!

Je suis dejas investi dans delic.

Bring it. I’m definitely interested

Hi, I’m interested in trying samples and possibly investing. What do I do next?

Hey! “Samples” are bit of a running joke here in the comments. You’ll have to check with your local regulations on what’s allowed where you are.

As far as investing is concerned, just check with your online brokerage on your investment manager. Happy to help more if necessary, just send an email.

The problem with anything new is states like mine are the last to get on board I suffer from depression nothing I’m taking seams to help I’m fed up with big pharma and the way states drag their feet

I can relate to that. 🙁 Might be time to take a trip.

Interesting

Does the company have plans to open clinics in Canada? Is the company working on products to address anxiety and depression?

Canada: I’m unsure

Other products: Most definitely. Delic Labs will be key here. But ALSO the idea behind having a large footprint of clinics is that no matter who develops a treatment, once it’s approved the Delic chain of clinics can administer those treatments.

Morning William,

Is Delic Labs working with Psilocybin mushrooms, I have heard that psilocybin resets the brain of those who suffer from depression.

I suffer from both anxiety and depression.

I would really be interested in the psilocybin research.

I would even be interested in offering myself to anyone needing test subjects.

I live in Pitt Meadows, BC.

I know the head quarters are here in Vancouver.

Delic doesn’t have any clinics in the Vancouver area yet. There are some companies working toward offering this kind of therapy in the area but I’m not sure the extent of their offerings at present.

Delic Labs is working with psilocybin mushrooms by the way: https://bc.ctvnews.ca/magic-mushrooms-coming-out-of-the-shadows-in-vancouver-1.5470518

Just purchased 400 shares. Make it work!!

Would love some free samples to help starting to treat my depression and anxiety

I’m definitely interested in the idea, I know the benefits of mushrooms. They’ve been used for years to treat so many different psychological issues & work better than chemicals. I’ve signed up for more info. Really would like to get some stock!

I myself have sealed with major depression issues. I am so tired of the roller costed ride along all the various pharmasicals that make you either sick , gain weight and do nothing it seems to improve the depression. Please make this work and come up with a fix for all of us suffering with this issue.

Will be investing and would love to offer myself as a test subject please

I’m just going to say it when are we going to start looking into ayahuasca now I understand psilocybin is great and it’s got more testing done but I think the benefits of Ayahuasca far outweigh but there’s no profit in something that unless they can work it into some kind of boat travel agency thing where you vacation formed around 2 life changing trip

I have growth exp and treat people with depression with mushrooms and i used them to help me recover from a major T. B. I. AND PTSD so what do you look for in employing a grower because from my exp different strain and a growth methods and amounts treat different problems

Tripping balls as medicine!? Sign me up!!

Samples would make it easier…

Very interested, and did someone say “free samples” I’d be very interested in those as well. Good to nlknow what I’m investing in.

OK, bought on your recc, (my first stock purchase ever at the tender age of 54!),… and now Etrade tells me I won’t be able to buy any more as of 9/28/21. How do we buy in US after the “No pink slip” rule change?!?

Hey, sorry for the delay here. Good question (and I think good timing!) I didn’t know that Etrade was doing away with Pink Slips. Are they still allowing trades on the OTCQB?

In any case, TDAmeritrade and Fidelity tend to be the most friendly to microcap investors. Feel free to reach out to me directly (email or FB or Telegram/WhatsApp) if you’re having issues and I’ll do what I can to help.

Interested

Would this market open up to people that are on their death bed, but are afraid to pass over that step?

I’m pretty sure the journey will help with this scared point.

Absolutely. This is one of the intended use cases.

I live by lake wales F.L….got me about acouple ounces fresh dfied psilocybin cubensis and blue meanie, petticoat mottellgills mix….I dose every 3 or 4 days..”Namaste”

Would like to know more about your company, do you have anyone in Oregon. I am a grower and want to do things legally. Do you work with any Oregon based groups?

Hey! Welcome to the site and thanks for joining the discussion.

I recommend reaching out directly to Delic Corp. Their website http://www.deliccorp.com has various channel of reaching them listed on it (phone, email, Socia Media, etc). They don’t have anything operational in Oregon YET but I know it’s part of the plan to get there.

Would like to get some information on your products

Free samples and info on your stocks to invest

I am thinking about investing but looked up DELC and nothing comes up. Could it be under something else?

If you’re in the USA it will be under the ticker DELCF.