Trillium Gold Mines Expands Asset Base with New Stake, Increases Private Placement Offering Due to Demand

Our top performing gold mining company, Trillium Gold Mines Inc. (TSX.V: TGM, OTC: TGLDF), kicked off the fourth quarter with an exciting expansion of its asset base and the upsizing of a brokered private placement due to excessive subscriber demand. Company management plans to commence drilling on its new acquisition immediately upon closing the deal in order to substantiate historic and geologic evidence suggesting that the property holds significant pockets of the ore. The upsized private placement will allow TGM to expand exploration on its numerous properties and support operating costs going forward.

The latest release of good news comes on the heels of a news-filled summer that included, among other things, the commencement of drilling at its flagship Newman Todd (NT) property and adjacent Rivard property, as well as the addition of more top-level mining expertise in the management team ranks. All of this recent news points to a company that is aggressively drilling for gold on its existing assets while also pursuing compelling opportunities to boost gold reserves during the early stages of what is expected to be a prolonged bull market in the commodity.

“Gold Centre” Appropriately Named

Trillium Gold is acquiring an 80% stake in a property called “Gold Centre,” undoubtedly named due to its location in the middle of the highest-grade gold camp in North America, with a 91-year production history topping more than 29.5 million ounces of gold at an average grade of 15.4 grams per ton. The Gold Centre property is adjacent to and on strike with Evolution Mining’s (ASX: EVN) Campbell-Red Lake Mine, which has produced 23.8 million ounces of gold at an average grade topping one-half ounce gold per ton (i.e., above the 15.6 g/t regional average). In fact, the western edge of the Gold Centre property lies just 350 metres from one of Evolution Mining’s producing mines.

TGM mining experts say that the same geologic structures conducive to substantial gold deposits found on Evolution Mining’s productive stake are present on the Gold Centre property. In fact, geologic mapping and previous drilling efforts suggest that the prolific gold-producing zone on the Campbell-Red Lake mine may extend through the Gold Centre property at depth. TGM believes that historic exploration efforts missed this high-producing ore zone and believes it can now tap into it by drilling deeper.

TGM CEO Russell Starr said, “Gold Centre has the potential to be a world-class asset and generate substantial value to Trillium Gold’s market capitalization and shareholder base. Our technical team is eager to test for the logical extension of the Red Lake mine’s mineralization onto the Gold Centre property.” Perhaps “eager” is an understatement, given TGM’s plans for immediately commencing drilling.

If TGM’s hypothesis proves true, success in this endeavor will become apparent quickly, as initial drill results could come in as early as late October. TGM is making a big financial commitment to the Gold Centre property, with timelines that encourage rapid exploration and development. The liquidity provided by the financing puts the company in the enviable position of being able to easily fund operations of all planned explorations and expand the scope of exploration efforts. TGM is fully capitalized and incentivized to move quickly, with its major shareholders in alignment with company initiatives, which the company has been executing flawlessly. We fully expect this to continue and note that even with the new investors, on a fully diluted basis, the company trades with only about 40 million shares, which will add booster power to the share price in the face of any new demand.

Should TGM find evidence of ore at Gold Centre at or near average grades for the region, it could serve as a jackpot that will propel the company’s share price to new heights and undoubtedly enhance interest from major producers. In fact, confirmation of gold reserves at any of their major properties would make them a prime target for takeover as larger producers are actively looking to boost their own reserves.

Subscriber Demand for Private Placement offering Exceeds Expectations

After announcing a C$8 million private placement offering with a mix of hard dollars and flow-through on Sept. 2, the company announced an upsizing of the offering to C$13 million later in the day due to exceptional demand. This news likely speaks to the power of the nascent bull market in gold as well as investors’ burgeoning recognition that smaller cap operations are well positioned to realize the biggest gains.

Upon release of the private placement offering news, the TGM share price dropped from its previous C$2.00-C$2.20 average five-day range to essentially match the C$1.70 basic unit price. This certainly wasn’t surprising as it is normal for stock prices to trade down to the financing price. We don’t believe the action was indicative of shareholder exit, but more a case of taking advantage of arbitrage. Stock price action displayed a sharp drop down to the financing point, but the financing filled up immediately and the stock price held and even came back a bit. Typically, with such deals, the share price drops down and stays down as the financing takes time to fill. The speed of TGM’s financing-stock price action leads us to believe that it will not take much time at all for a reversal and resumption in TGM’s share price ascent.

Any ascent would be amplified by the low float, as well as numerous catalysts that could rapidly propel the share price. Key among these potential catalysts are drilling results from the company’s flagship Newman Todd (NT) property, as well as from its Leo property, as reported in our July 28 article, “Drilling Deep: Trillium Gold Mines.” The company also announced on Aug. 20th the commencement of exploratory drilling on its Rivard Property, located adjacent to the Newman Todd claim. Exploratory drilling at NT, it should be noted, was delayed in part due to forest fires in the area but has since resumed, and initial results are likely within the next few weeks.

Heady Times for Gold

All in all, these are heady times for gold investors and for Trillium Gold. That said, the spot price of gold appears to be taking a breather after its robust and rapid climb to all-time highs from July into August. As reported in our Aug. 26th blog—”As Gold Takes a Breather from Breaching New Highs Key Questions are how Much Higher and How Much Longer”—we believe this pause in the new bull market in gold will be temporary. It won’t take much to put the rising price of gold back into gear and any positive findings from TGM’s recent initiatives will easily push TGM’s share price much, much higher. Combined, the two make an explosive combination that could truly make Trillium Gold the most talked about microcap gold mining company of this nascent bull run. That is, until it is taken over by one of the major producers or leaves its microcap roots behind.

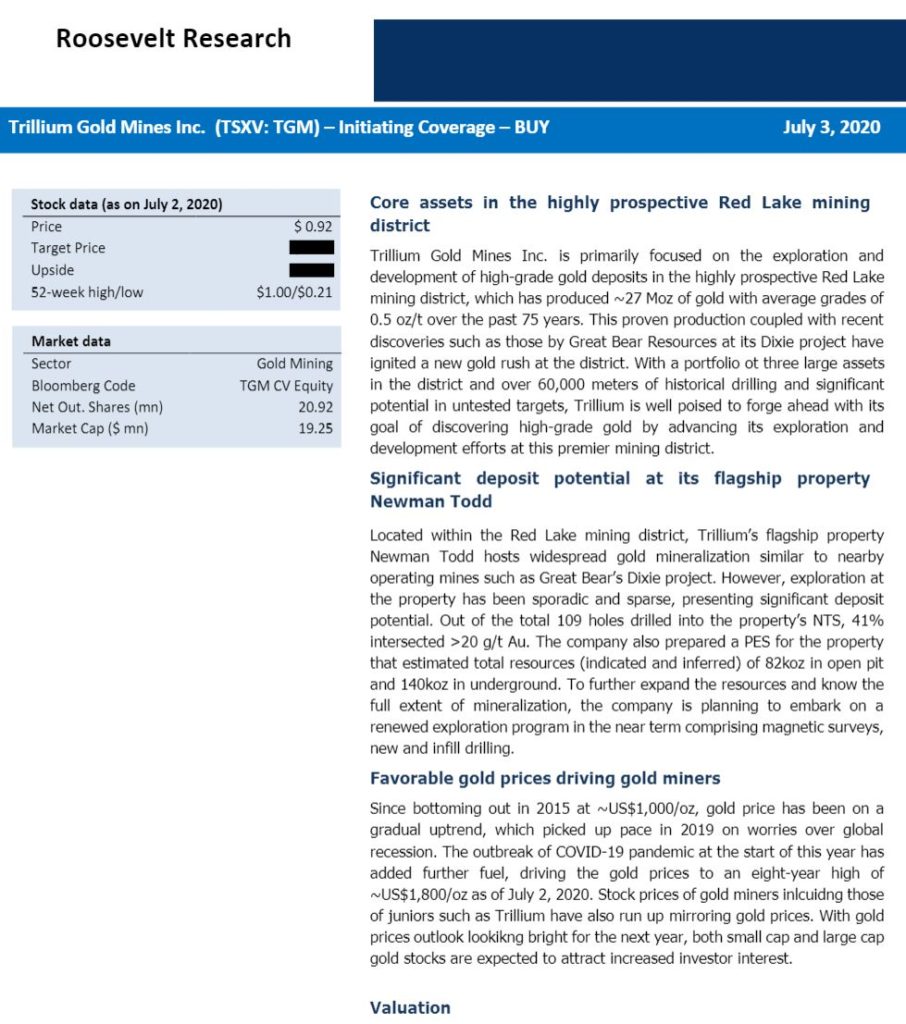

Our price targets from the July research report were based almost solely on the Newman Todd asset alone. With the aggressive acquisitions in Red Lake and a rising price of gold those could easily get blown out.

Read this next:

Disclaimer

The Momentum Letter is a marketing partner which has received

compensation to direct traffic to this coverage. Full Disclaimer