Multiple Catalysts in Place for Lakewood’s Silver Hammer

It’s an exciting time for silver investors. The precious metal itself is teetering on the fringe of meme stock status by being the topic of conversation of many reddit community investors while #silversqueeze is trending heavily on both Twitter and Stocktwits. Silver is certainly a different beast altogether than AMC or GME but I think we can agree that the more investor attention on silver the better.

Additionally, global industrial demand for silver is surging as its use cases in batteries, solar technology, computer chips and touch screens are all seeing exponentially increasing production. Couple with this the unsurprising consequence that over the past decade the silver industry has been in a 500M ounce physical deficit and the case for investing in silver miners and prospectors becomes ever more compelling.

Technical indicators are also printing bullish signals for silver miners. The 50 day simple moving average surpassing the 200 day moving average is a ubiquitous buy signal for traders of all types and often marks the beginning a prolonged bull run.

What Does This Mean for Lakewood and Silver Hammer?

Leverage!

Typically an investment in exploration companies acts like a leveraged bet on the underlying commodity. A 50% increase in commodity price can sometimes send the best prospects’ share price surging by many multiples.

The beautiful thing about Lakewood’s (CSE: LWD; OTC: LWDEF) Silver Hammer assets is that while it offers leveraged exposure to the potential upside in silver prices, it also has several buffers in place mitigating exposure to the downside.

Consider the following:

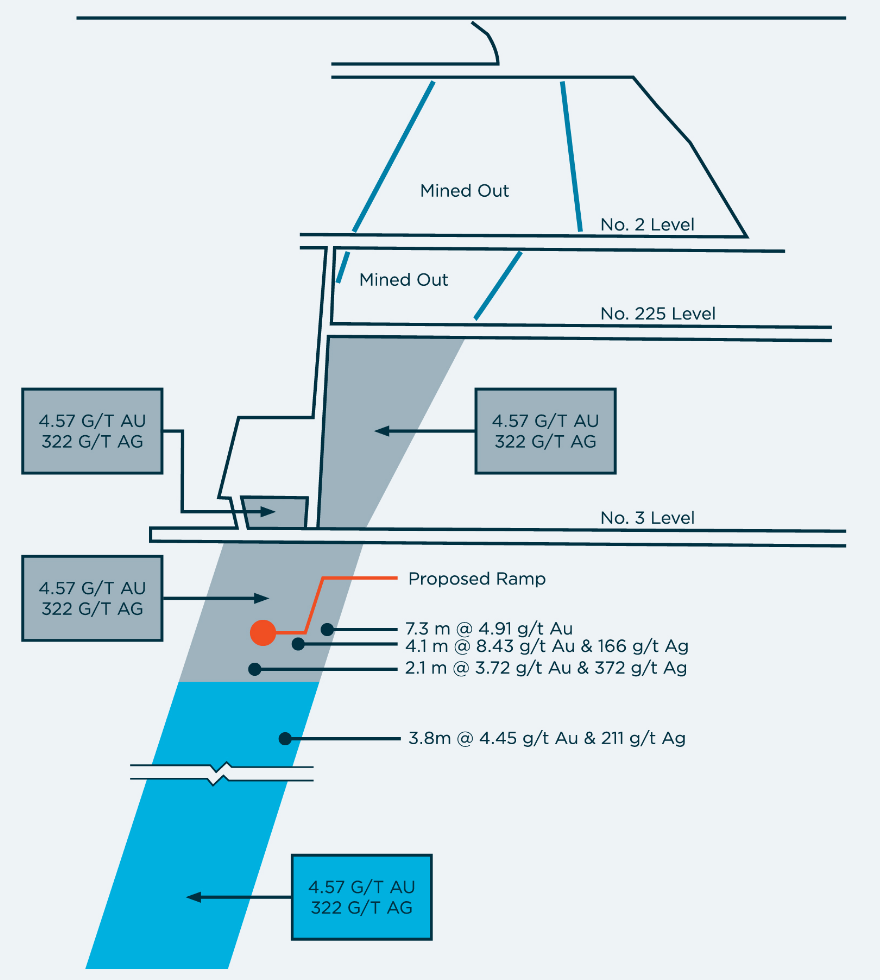

- The past producing Silver Strand mine has been mined to 90 meters depth but has (non 43-101 compliant) assays reporting viable production grades down to 300+ meters.

- Traditional break even UG numbers could still make production viable with spot precious metal prices at less than 40% of where they sit today.

This makes the exploration significantly de-risked. Lakewood’s first steps will be to compliantly confirm the old workings. That alone could validate the viability of small scale production.

The real up side, however, lies in the possibility of getting to large scale production.

Lakewood Entering Elephant Country

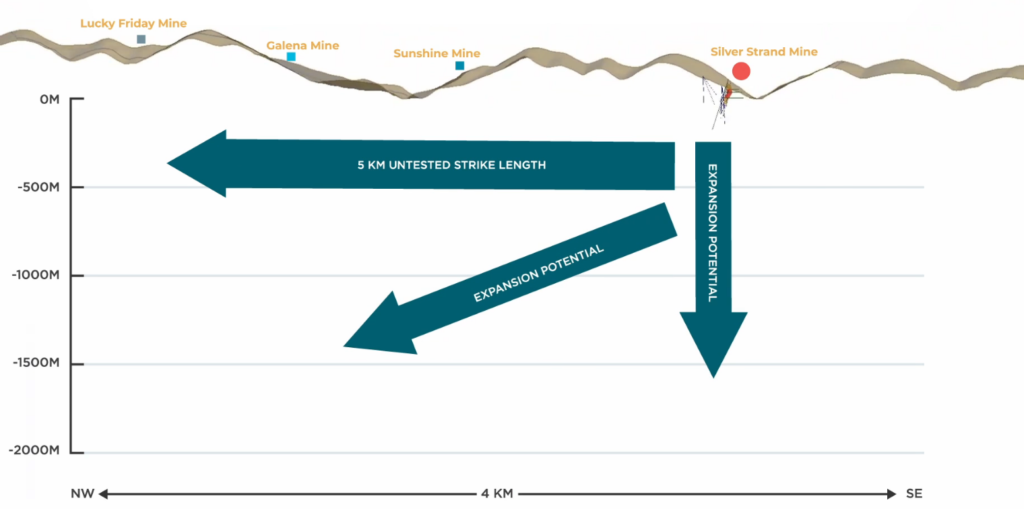

The Silver Valley – Coeur d’Alene Mining District – is undoubtedly Elephant Country. The district has produced more than 1.2 billion ounces of silver in its history. Furthermore, other mines in the region have produced 100s of millions of ounces of silver each.

The Galena mine has produced 200M oz of silver. Sunshine mine has produced 362M oz of silver. And Coeur dAlene is also the home of Hecla Mining’s Lucky Friday Mine which has produced 89M oz of silver.

That’s the real potential upside in Lakewood’s Silver Hammer assets – discovering large scale production quantities of silver.

It is my understanding that both the previous bear market in precious metals and a claim dispute halted operations on the assets now in Lakewood’s possession. Silver Hammer resolved the dispute by purchasing both assets.

Remember, these were both shallow mined assets (90m) in a region where surrounding mines have produced at depths down to 1900m. Less than 5% of the possible depth has been properly explored.

Now that Lakewood controls the claims they can diligently explore both at depth and along the trend between the two past-producing mines.

I’ll follow up with a more detailed analysis in the coming weeks. In the meantime please let me know if you have any questions or topics you’d like to see addressed in that follow-up. You can reach me in the comments below or send a message to my email or Facebook inboxes.

Bill McClain – Editor of The Momentum Letter

About the author.

Disclaimer/Disclosure: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. All statements in articles on this website are to be checked and verified by the reader. Read our full disclaimer/disclosure here.

Disclaimer

The Momentum Letter is a marketing partner which has received

compensation to direct traffic to this coverage. Full Disclaimer

Silver Strand is a unique and valuable resource having both gold and silver. Also the right rock types to produce that are similar to producing mines of the Silver Valley Silver producers.

Also this is near surface and not deep mines like th Galena, Lucky, Friday, Sunshine or Crescent where hoisting and transportation cost are excessive.This property is poised for production Now!!!